January 31, 2023

A Persistent Hangover

We enter 2023 reeling from the worst investment conditions in generations, which were precipitated by the high cost of three wars: the Russian invasion of Ukraine and the battles against inflation and COVID. A few weeks into the New Year, it’s clear that these struggles will continue longer than any of us had hoped.

It’s human nature to expect the future to look very much like the recent past. Indeed, a year ago the overwhelming consensus was that the strong market and economic performance of 2021 would continue into 2022. The Funds rate was at zero and the next interest rate hike was forecast at just 0.25% and was not expected until December 2022. We were coming off a 48% surge in corporate profits and an 11% increase in nominal economic growth. The Fed remained dead set on fueling the economy by purchasing bonds and keeping interest rates low. Asset prices and profits were at record highs, cash was flush, employment was full, inflation was “transitory,” policy was immensely accommodative, reopening was well underway, and optimism prevailed. There seemed to be no reason to believe the party would end soon.

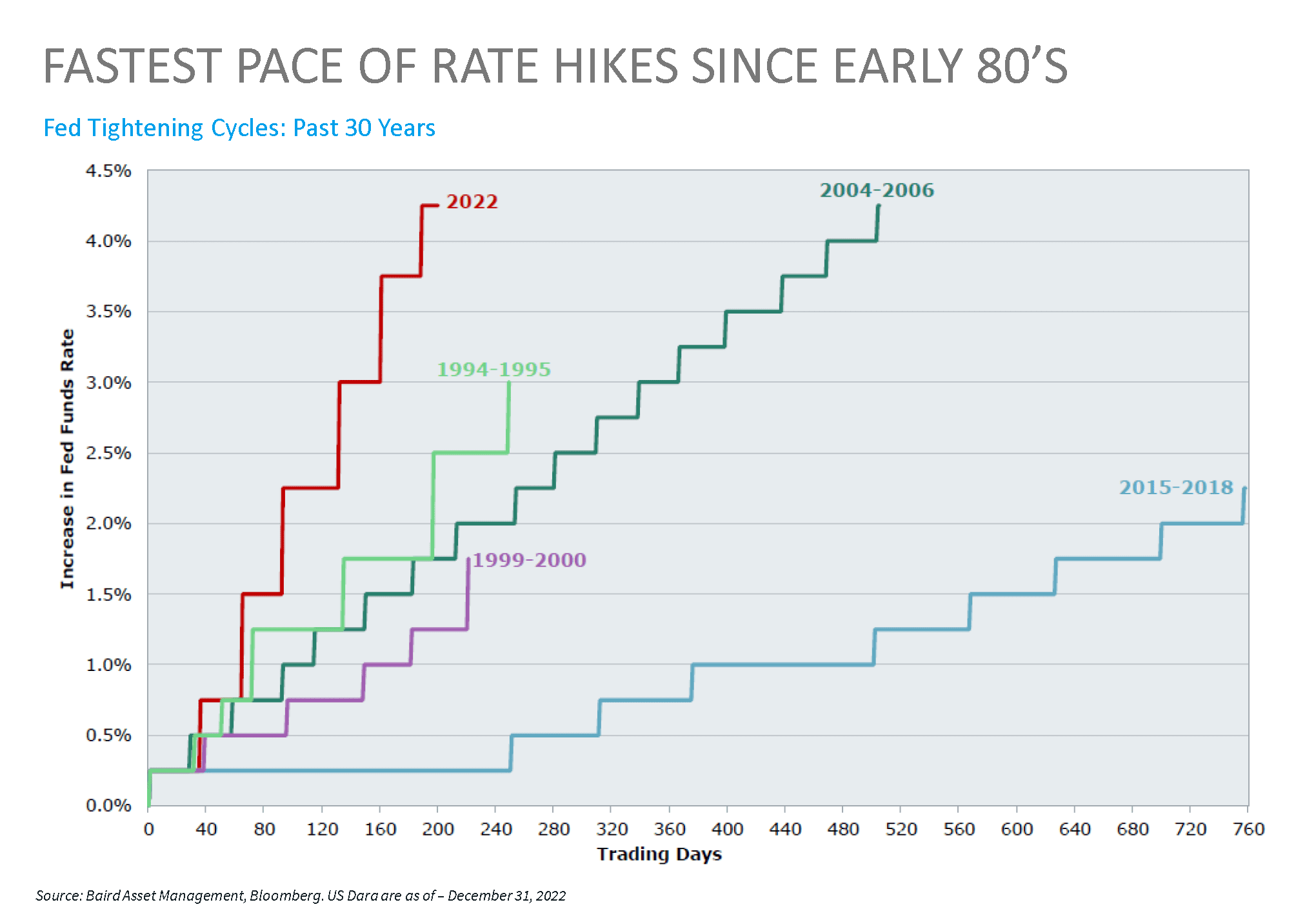

We highlighted plenty of reasons to be concerned in our 2022 Outlook, aptly titled The Party is Over. Even so, we were blindsided by the dramatic turn of events last year. The biggest surprise in 2022 was the Russian invasion of Ukraine, followed by persistent and accelerating inflation, ongoing supply chain disruptions, and the implosion of speculative investments (SPACs, crypto, and profitless technology companies). Meanwhile the Fed kept purchasing bonds until June of 2022, pouring inflationary fuel on the fire. The Fed hiked interest rates not 0.25%, but an unprecedented 4.25% over the course of 10 months – the fastest pace since the early 1980s (chart). Expectations are that the Fed will continue hiking rates to 5%. Inflation hit a 40-year high of 9% and stayed above 7% most of the year. Real estate, IPOs, and merger transactions screeched to a halt. Real GDP declined the first two quarters and bonds posted their worst year of returns in generations. US stocks and bonds both lost more than 10% for the first time on record. Given the backdrop of speculative excess, geopolitical turmoil, and policy mistakes, it’s surprising broad market performance wasn’t worse in 2022.

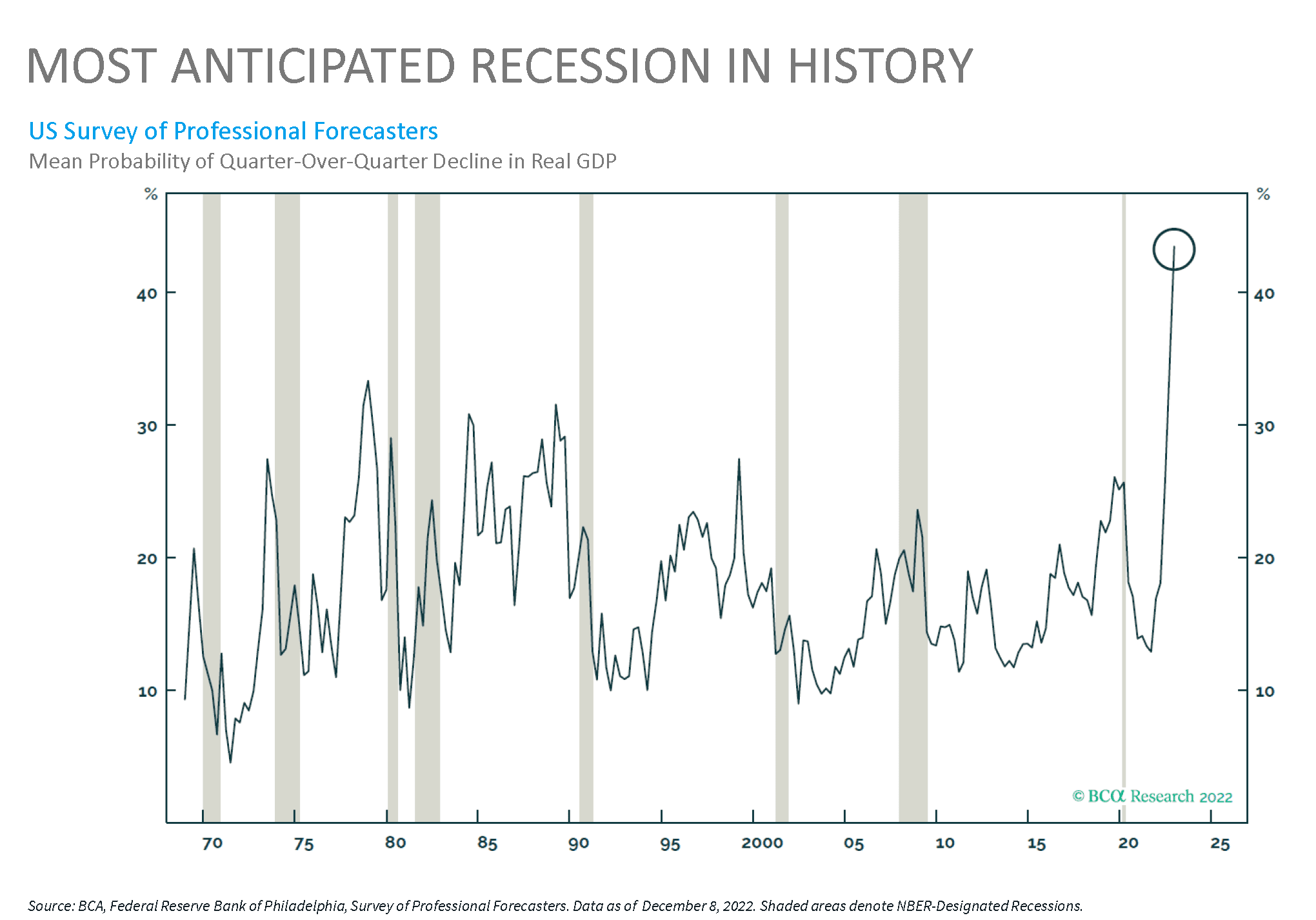

As we enter 2023, the overwhelming consensus is that the conditions that prevailed in 2022 will continue. Once again, forecasts resemble the recent past: inflation and high interest rates will drag down economic activity, earnings, and asset prices, risking a recession as the Fed continues to hike rates toward 5% to achieve price stability. Many strategists expect a mild to severe recession in the first half of the year as the recent interest rate hikes have the intended effect of slowing economic activity. A survey of professional forecasters in December showed the highest probability of a recession on record (chart). Recessions can be very difficult, but they also represent a healthy process for the capital markets, clearing excess speculation and unreasonable expectations. Like a nasty hangover, an interest-rate-induced recession will be the price paid for our post-pandemic profligacy. Or so the consensus thinking goes.

It’s also human nature to delay paying the price for past mistakes. We think the surprise this year will be that the day of reckoning will be pushed to the back half of the year and dampened by broad-based resilience. Economic activity is slowing, wage growth is moderating, employment remains strong and inflation expectations are anchored at 2.5-3%. The financial system is the most well-capitalized in decades, speculative excesses have been wrung out, and the risks are largely – though perhaps not fully – priced into most assets. The positive macro environment characterized by decelerating inflation and moderate albeit slowing growth has provided a tailwind to risk assets at the end of 2022 and into 2023. The question is, how long will it last?

2023 Outlook

As we stumble into the second half of the year, we expect the unavoidable hangover will emerge: excess cash balances will be depleted, defaults will start to rise, layoffs will increase, interest costs will stifle investment, and profits will come under pressure.

We agree with the consensus that the U.S. will experience a mild recession in 2023, but we think the first part of the year will bring surprising resilience and the recession will be delayed until later in the year. Inflation and wage growth will likely settle into a 3-4% range by mid-year, which is still too high. The job market should remain strong, providing cover for the Fed to continue rate increases without causing a serious spike in unemployment. The Fed’s aggressive interest rate hikes from 2022 will start to take effect in the spring/summer of 2023. Defaults and unemployment will rise in riskier sectors first, leading to a more broad-based recession by the third or fourth quarter. The banking system is the healthiest it’s been since WWII and consumers are still in great shape, and this should dampen the worst of the effects.

2023 Portfolio Tactics

Challenging markets often present opportunities for tactical adjustments. History reminds us that predicting economic events and their impact on asset prices is challenging. The timing and magnitude may not be perfect, but directionally, we believe the following short-term actions should help our clients get closer to their long-term goals.

Long-term consistency trumps short-term intensity.

Bruce Lee

Our tactical positions heading into 2023 include:

- Allocating more to less-risky investments. Cash and high-quality bonds are earning significantly higher yields than they were a year ago and shorter-term rates are higher than longer-term rates. With yields higher, we are now getting paid to be patient.

- Remaining slightly overweight U.S. stocks relative to strategic targets. U.S. stocks should respond positively to the economy’s resilience, although we do expect volatility. Where 2022’s drop was primarily due to the rising discount rate, 2023 will be defined by lower earnings as the economic slowdown takes hold. (Earnings can decline without a full-blown recession.) Bear markets typically don’t end with P/E multiples this high (17x), especially when inflation is elevated.

- Maintaining allocations to international developed markets. Parts of Europe may already be in a recession, yet green shoots are beginning to surface thanks in large part to a mild winter. Given that valuations look relatively attractive and the U.S. Dollar is stretched, we believe international developed equities may be strong performers in 2023.

- Utilizing active management in emerging markets, especially China. The outlook for China is muddled. The government’s abandonment of its zero-covid policy and recent moves to attract foreign investment have provided a potential boost to economic growth in 2023, but demographic trends and constraints on free enterprise, human rights, property values, and geopolitics have us concerned. We prefer active management that can navigate these risks more effectively than a broad-based index fund.

- Reducing allocations to high yield bonds, real estate, and private equity, all of which seem overvalued. The low premium for credit risk indicates these investors are pricing in a scenario of moderate growth, low inflation, and lower interest rates this year. We think that’s too optimistic. While publicly traded stocks and bonds are leading indicators and will likely recover well in advance of the economic cycle’s nadir, private markets will likely be swamped with excess capital, write-downs, and a dearth of IPOs and corporate acquisitions over the next few years. We prefer private credit (though we are mindful of leverage and liquidity risk) and insurance-linked securities.

You might be wondering why we are still overweight stocks if we think a recession is likely and there’s possibly more downside. It’s actually not as unnatural as it sounds. First, the consensus could be wrong (as it often is when it comes to economic forecasting), and we could skate through this downturn without a recession. Secondly, stocks do not move in lock-step with the economy, as noted above. Thirdly, as long-term investors, we prefer to weather market cycles rather than trying to time them. Markets typically turn when sentiment is the most negative. And finally, stocks are among the best asset classes to own as an inflation hedge.

Our long-term return expectations for stocks and bonds are higher than they have been in years. The primary cause was the shocking jump in both interest rates and inflation expectations. We are tempted to compare this era to the 1970’s or 80’s, but everything moves more quickly these days than it did then. It pays to be both nimble and patient. Tough times create tactical opportunities, but they don’t generally warrant larger strategic changes. We will adjust your investment strategy only when your risk tolerance, investment horizon, income and cash flow needs, or other objectives have changed – not in response to market moves. Your Fulcrum advisor is here to help you weather whatever the economy and markets have in store. Please don’t hesitate to reach out if you have any questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.