January 22, 2021

THE ROAD TO RECOVERY

by Michelle Mathieu

As we look out across the global investment landscape, we expect most stock markets will end 2021 modestly higher, fueled by low interest rates, additional government spending, and eventual re-opening of economies following broad vaccine deployment. However, we have some concerns and do not expect the road to be smooth or easy; a temporary relapse is likely.

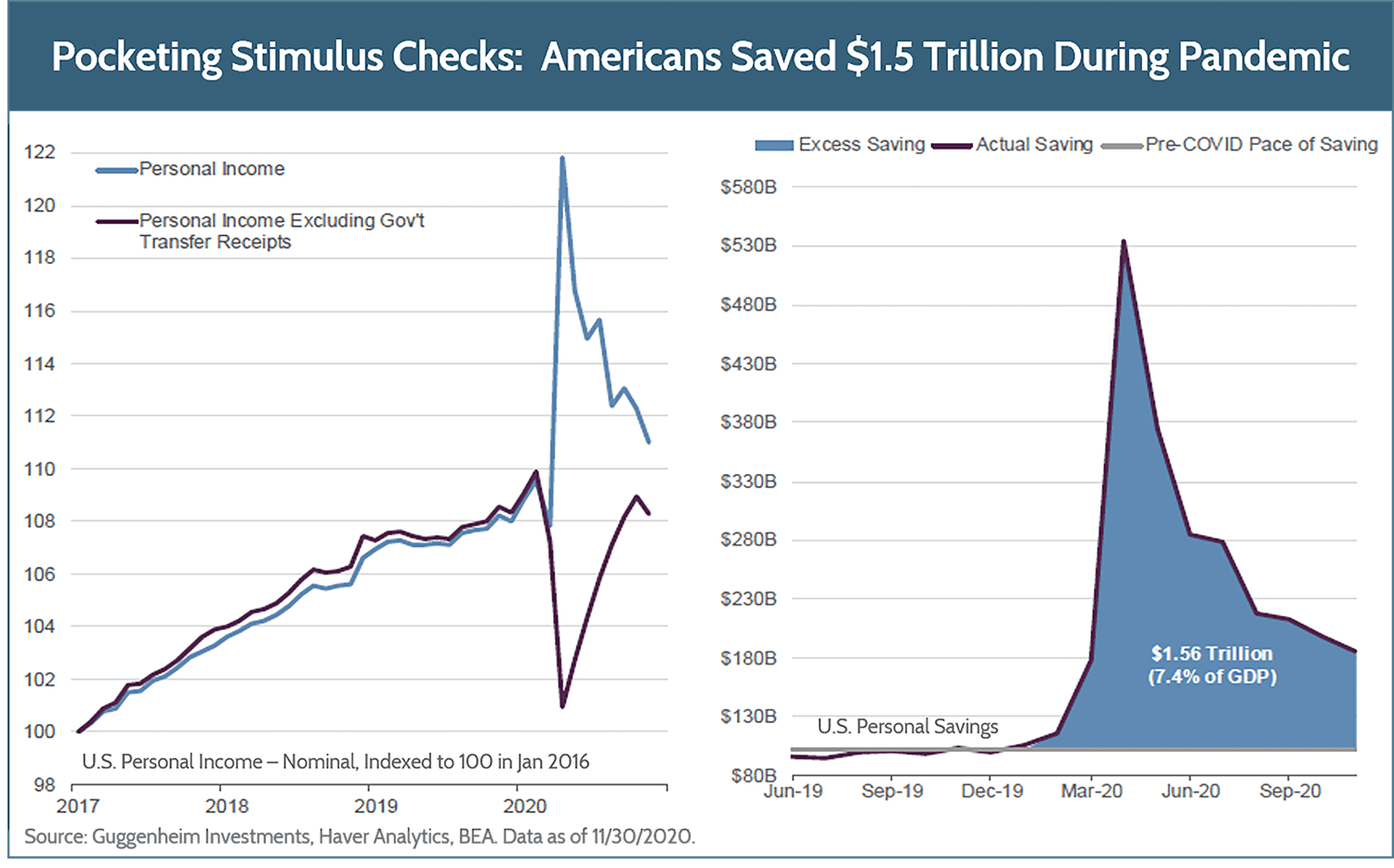

As investors, we are trained to focus on the direction rather than the level of markets and other indicators. Asset prices reflect a discount on future – not past – growth and earnings. Looking ahead to the next 12-18 months, we believe the direction will be generally positive. Manufacturing activity is at a two-year high and expanding, asset prices are supported by low-interest rates and easy credit conditions, and companies and households are flush with cash (see chart below). Forecasts call for 5.7% real global GDP growth in 2021 – the fastest rate in at least four decades. Pockets of weakness in the U.K., France, and Japan are not expected to drag down the powerhouse U.S. and Chinese economies.

The largest single engine for global growth are U.S. consumers, whose spending makes up roughly two-thirds of U.S. GDP. That segment is quite healthy, at least financially, if not physically. The massive stimulus programs in 2020 bolstered household wealth and drove over $1.5 trillion of excess savings. Total income (wages, salaries, and government transfer payments) is currently 2% higher than before the pandemic hit in February, and the recently proposed stimulus package could increase this another 10% or so. Most people are either saving their stimulus checks or using them to pay taxes or reduce debt. On average, Americans have plenty of money; they just can’t spend it due to the pandemic. Some believe the reopening of the economy later this year could unleash this century’s version of the “Roaring 20’s.”

Potential setbacks

There will unquestionably be setbacks along the way. In February 2020, the clock started on a new global economic cycle unlike any other, exceptional in its breadth, brevity, and severity. As has happened with every past cycle, there will inevitably be an interim correction in the long-term trajectory. The first relapse could be precipitated by rising COVID cases, new strain variants, and vaccine delays. The grim anniversary of the outbreak in mid-January saw global COVID-19 cases approach 93 million and deaths top 2 million, with the U.S. accounting for one-fifth of that total, according to Johns Hopkins University.

Political and social tension, economic uncertainty, and rising inequality are keeping a lid on consumer and business confidence. Here, the direction is clearly not positive. 7.8 million more people were below the poverty line between June and November, according to academic economists Bruce Meyer and James Sullivan at povertymeasurement.org, even as the unemployment rate fell from 11.1% to 6.7%. Meanwhile Black Knight, a provider of mortgage data, estimates 2 million more mortgages are delinquent now versus before the pandemic. The number of unemployed individuals is roughly 10 million higher than a year ago, with about one-third of those in the leisure and hospitality industries. Many of those jobs will not be coming back, but digital transformation has spawned entire new industries, demonstrating both the pain and benefit of creative destruction.

As we move into the second half of the year, the specter of tax increases for corporations and high earners could hamper the recovery just as the government begins pulling back on stimulus measures. Impaired valuations for commercial real estate pose another significant threat to the recovery. Meanwhile, the extraordinary $3 trillion intervention by the Federal Reserve may trigger higher inflation, U.S. dollar weakness, and future asset bubbles. Add the possibility of virus mutations and unstable geopolitics to the mix, and there are plenty of things to keep the doomsayers topping the headlines.

While these dangers are real, they are not very present. There are four powerful positive forces fueling our optimism for the year ahead: 1. additional fiscal stimulus, 2. continued low interest rates, 3. strong earnings for businesses and individuals, and 4. better control of the pandemic with vaccines.

A similar refrain

As in 2020, the entire world is singularly focused on containing the virus in 2021. When everyone is focused on the same thing and on ensuring it will go right, it probably will – everything else takes a back seat by comparison. After the virus is contained and the economy reopens, then our attention will turn to whether, how, and when we’ll pay the five trillion-dollar bill that first started to accrue in 2008. We believe this cycle of piling one debt-financed deficit on top of another could go on for some time.

To be sure, current market dynamics leave little room for error and suggest an underappreciation of risk. While we expect 2021 will be very calm compared to 2020, we do anticipate some bouts of volatility in the months ahead. But 2020 reminded us why we should stay committed to your long-term plan. As always, we are staying focused on the big picture to identify investment opportunities and mitigate risk.

Thank you for entrusting us with your financial well-being during this challenging time. It is a profound responsibility that we do not take lightly. We are available to support you and answer your questions as you navigate the weeks and months ahead.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.