April 16, 2019

READY POSITION

By Michelle Mathieu

In the first quarter of 2019, recession fears quickly surrendered to optimism when, in late January, the Federal Reserve announced they would hold off on hiking interest rates. Investors celebrated the move — which coincided with the 10th anniversary of the longest bull market on record — by driving up prices of risky assets and commodities. Global stocks rose double-digits in the first quarter, led once again by the S&P 500 Index, which posted its strongest start in more than 20 years and is now more than 20% above the December lows.

Amidst all this, it’s easy to forget the abysmal performance of the fourth quarter of 2018. In our January update, Stay the Course, we discussed the reasons investors were concerned about an imminent recession and trade wars, and we encouraged readers to – you guessed it – stay the course. This quarter, we take it a step further. After a big move like the one we just experienced, it’s time to re-center on your long-term strategy. It’s time to get portfolios back to their ready position.

Ready position is the stance athletes use to create a strong, agile base. Tennis, baseball, soccer, fencing – all sports have a ready position. From there, an athlete is prepared to strike or defend, depending on the situation. By bringing portfolios back to ready position, we are making sure we won’t be caught off-balance. And, we can stay neutral as long as necessary.

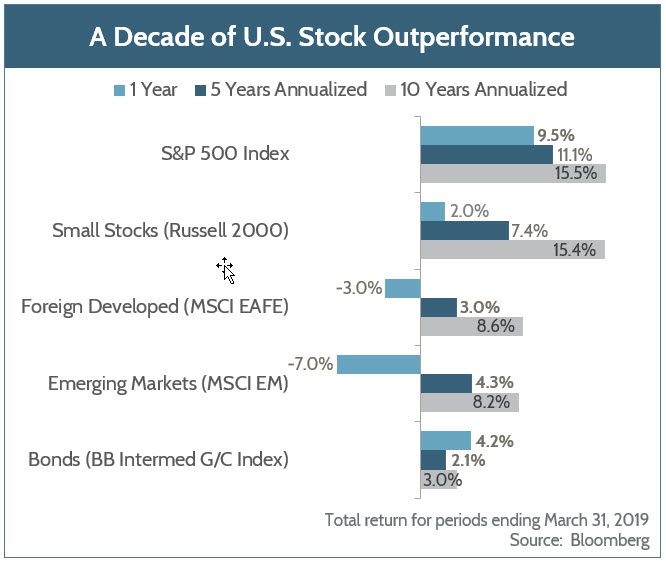

Over the past decade, most clients of Fulcrum Capital have enjoyed the benefits of being overweight U.S. stocks. We’ve been overweight in two ways: relative to bonds, and relative to foreign stocks. In the 10 years since the start of the recovery from the Great Financial Crisis in 2008, the S&P 500 Index has returned 15.5% annualized. That is 7% more than foreign stocks, and 12% more than bonds on average every year! Similarly, this performance is more than 6% above the S&P 500 annual average return going back to 1929. As we’ve shared with you consistently over the years, we held course over that period, maintaining our overweight to U.S. stocks through the intra-year declines. A favorable backdrop of earnings growth, sentiment, fiscal policy, credit conditions, valuation, and the macro environment have supported this position.

Cautious Optimism

We still believe this cycle has legs, and we aren’t prepared to call the end of the bull market just yet. Policy conditions are improving. There are signs that Europe may emerge from recession, and China seems to be recovering from a soft patch. With the decline in long-term interest rates, bonds aren’t necessarily an attractive alternative to stocks. However, stocks aren’t necessarily cheap here, either. Corporate profit growth is decelerating as the economic cycle matures, and profit margins may be constrained by a tight labor market and rising wages. In fact, stocks, bonds, credit, and real estate all appear expensive. Last year, we pointed out how rare it was to see all asset classes decline at the same time. It also has rarely been the case that all assets are expensive at the same time, a byproduct of prolonged easy monetary policy. Frankly, our long-term outlook is more balanced than it’s been in a long time. After this surge in valuations, we recognize that stock exposures may be a bit overextended.

Get While the Getting’s Good

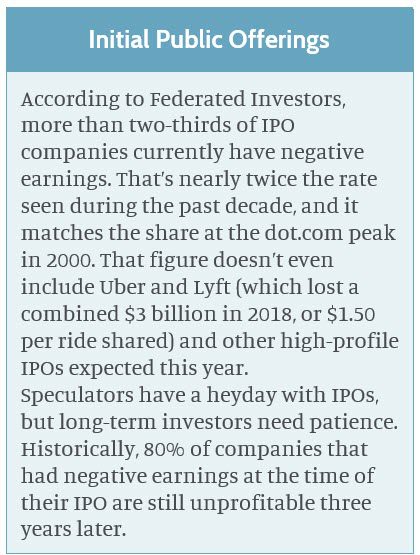

It always pays for investors to be aware of risk. Still, there are times to be more aggressive, and there are times to be more defensive. As we have shared with you over the past decade, we have been leaning aggressive. But looking ahead, we believe the upside is more muted. Investors are finally starting to get greedy. An example of this is the volume of IPOs expected this year. Renaissance Capital estimates that up to 200 companies will go public this year. Could it be that these private companies are going public while the gettin’s good?

We wonder whether investors will clamor for Uber at a valuation of, say, $120 billion with the same enthusiasm that they greeted Amazon at $400 million.

Time to Rebalance

Over time, as the returns of assets diverge, a portfolio can unintentionally drift from the desired position. Rebalancing from one asset class to another is one way to put the portfolio back on track. The tricky part is knowing when to rebalance. Some advisors recommend monthly or quarterly rebalancing, others annual. Still others don’t watch the calendar at all, and only rebalance when a threshold is hit, say, 5% or 10% from target.

We believe a threshold approach is more prudent than a dogmatic calendar-based approach. If a policy threshold is breached, why would you wait to address it if it’s still out of line when the next quarter or year-end rolls around? That makes as much sense as a teacher only taking attendance on the first Tuesday in March, or an alarm only working one day every three months. We understand the appeal of the mechanical rigor of a calendar-based approach, but the passage of time has little to do with relative value. Our portfolio management tools let us efficiently monitor portfolio drift daily.

We also believe less frequent rebalancing is better, as it reduces transaction costs and mitigates taxes. Asset prices are not entirely random, and there is some benefit to letting prices drift.* At Fulcrum, we monitor portfolios continuously and rebalance when portfolios deviate more than 10% from their allocation target. When available, we use cash flows to bring portfolios in line, and we pay attention to taxes and transaction costs. We also review every portfolio at least annually to make sure it is in line with its overall Investment Policy.

Back to Neutral

When it comes to rebalancing, as with most things, having a discipline and sticking to it matters as much as the discipline itself. We are taking this opportunity to rebalance portfolios, and we are bringing them back in line with their long-term neutral targets. From this strong, agile stance, we are ready for what’s next.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.