January 3, 2023

Market Review: 4Q 2022

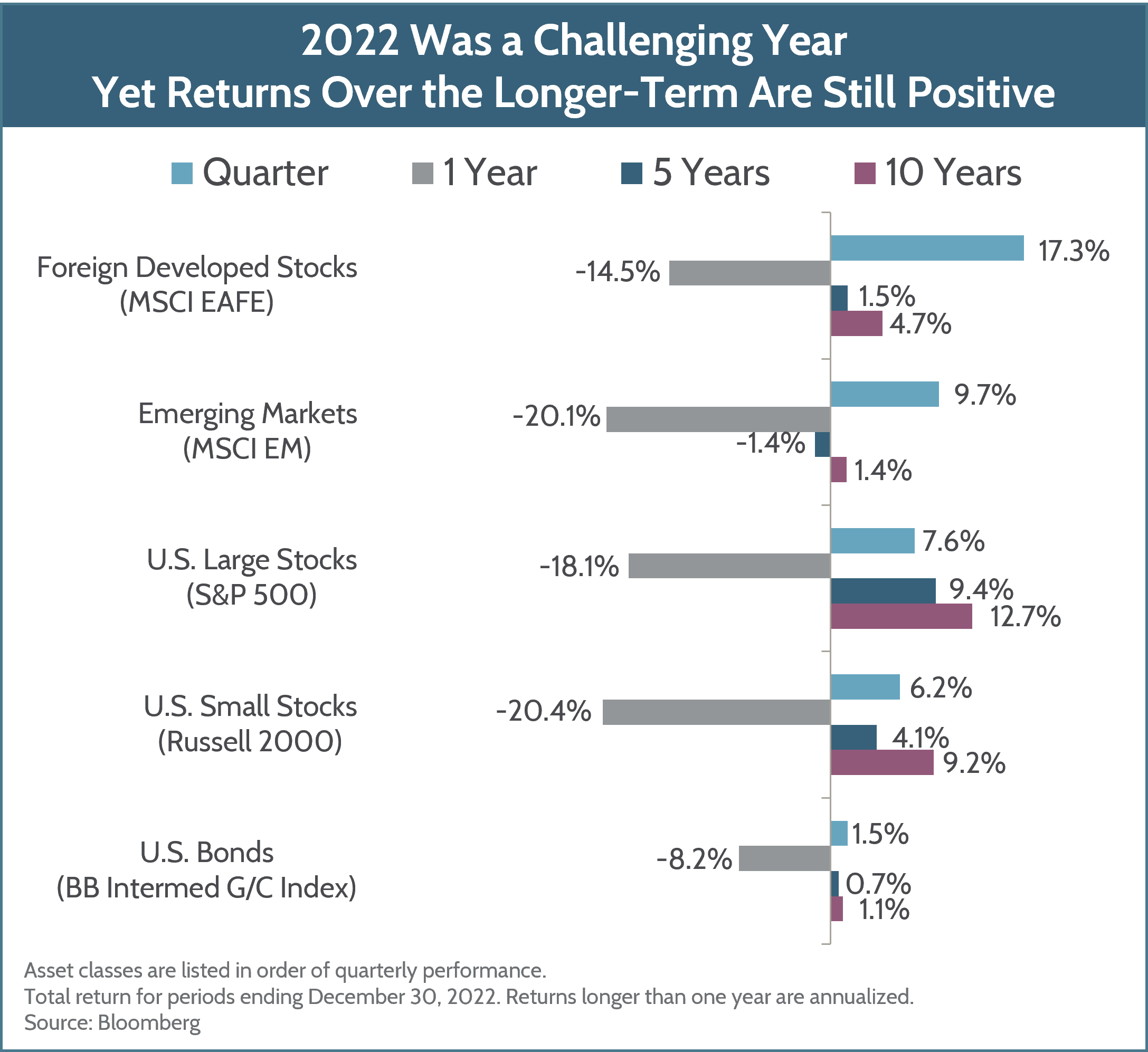

Like most investors, we were relieved to see 2022 end on a positive note. After two consecutive quarters of negative real US GDP growth, the US economy reversed trend and grew by a 3.2% annualized rate in the third quarter. Real consumer spending, investment spending, and increases in exports led to the strong GDP figure for the quarter. Outside the US, most major economies continued to slow while central banks across the globe implemented restrictive monetary policies to combat inflation. Indeed, signs emerged that inflation is easing globally, and stock markets responded positively, with foreign developed markets staging the strongest rally, up 17.3% for the quarter. Emerging markets also delivered strong returns as China abandoned its zero-Covid policy earlier than expected. US stocks and bonds both rose during the quarter, yet lost steam into December as the Fed indicated that, even with slowing inflation, they intend to raise interest rates further in 2023 and risk pushing the US economy into a recession.

Despite the recovery in the fourth quarter, the S&P 500 index of US large stocks ended the year down more than 18%, small stocks and emerging markets were down more than 20%, and foreign Developed stocks dropped over 14%. 2022 was the first year on record that both stocks and long-term bonds lost more than 10%. The lone bright spot was energy, with Brent crude oil up 39% for the year and energy stocks in the S&P 500 index surging over 65% for the year.

In terms of corporate health, US earnings generally beat expectations for the quarter and delivered revenue and earnings growth that was positive but slowing. Analysts revised their expectations for 2023 earnings downward during the quarter, but expectations still point to continued profit growth in the new year.

The big news for the quarter was that US inflation came in below expectations for two months in a row. As supply chains began to normalize and consumers shifted their spending from goods to services, core goods prices softened, helping offset stickier pricing pressure in core services. Meanwhile, mortgage rates near two-decade highs are beginning to influence the housing sector and, by extension, inflation expectations as home prices and rents nationally are compressing.

With the improvement in inflation accompanied by sustained strength in employment numbers, the Fed continued to signal expectations that the Federal Funds Rate will increase from 4.5% today to at least 5% in 2023. For perspective, the current pace of Fed tightening is faster than any previous cycle over the last few decades and is the most aggressive since the early 1980’s. 10-Year Treasuries were yielding 1.5% at the beginning of 2022 and ended the year at 3.9%. On the bright side, forward-looking yields on bonds are much more attractive than they were a year ago.

As we move forward into 2023, the same themes that drove the stock and bond markets in 2022 are relevant in the new year: inflation, interest rates, and their impact on corporate profits. The threat of an end to three decades of geopolitical cooperation – which played a major role in global disinflation – also suggests further instability ahead, and we recognize that this instability brings opportunities as well as threats for portfolios.

At Fulcrum, we continue to focus on investing in what we believe to be quality, profitable companies that are well-positioned to sustain cash flows and earnings through the current economic environment. Staying invested during such a challenging market environment, in our view, is critical to success and your Fulcrum advisor is here to help you maintain focus on your long-term goals. Please keep a look out in the coming weeks for our 2023 Outlook for more detail on our thoughts on the investment landscape and don’t hesitate to reach out to your advisor with questions.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.