January 4, 2021

Market Review: 4Q 2020

by Tim Clark

The year 2020 will be remembered as a year like no other. Not since World War II has the entire global population been impacted in such a profound way. As of the end of 2020, the world has seen over 1.8 million deaths from Covid-19, with almost 20% or 353,000 fatalities occurring here in the United States (John Hopkins University). That is, indeed, a sobering statistic. Heartache has also been felt by families all over the world who were separated from loved ones or suffered economic hardship due to the lockdowns. The global pandemic increased political divisiveness and accelerated economic inequality, and the battle against racial injustice and climate risk escalated across the globe. We have all been touched by these extraordinary events this year. Fortunately, there is a gleaming light at the end of this tunnel. Unprecedented global coordination to develop a vaccine has resulted in at least three effective inoculations that were created at a record pace. One positive deduction from 2020 is the human race’s ingenuity and resilience in times of tremendous strain and adversity.

The impact of the pandemic on the economy and the markets was extraordinary. We saw the largest collapse in U.S. gross domestic product (GDP) on record in the second quarter and the largest decline in annual GDP since 1946. The S&P 500 recorded the fastest bear market ever, falling over 33% in just over a month. The recovery has also been unprecedented, with the S&P 500 rebounding over 67% from the lows of March to year-end. Massive coordinated fiscal and monetary stimulus across the globe stemmed an economic catastrophe. Policymakers implemented fiscal easing that was swifter and greater than that of the Global Financial Crisis in 2008. Government spending of approximately 8% of global GDP increased global public debt levels to roughly 100% of GDP, the highest level in history. Global residential real estate, notably single-family homes, also surged during the year, driven by historically low interest rates and the shift to working from home. Ironically, many have seen their net wealth increase materially in 2020. The U.S. population in aggregate is currently sitting on excess savings of about 6% of annual GDP or $2.5 trillion, accrued as a result of government stimulus. But not everyone is benefiting. Small businesses, minorities, and the hospitality, travel, and oil industries have been disproportionately impacted. Unfortunately, the Covid-19 pandemic will most likely exacerbate global wealth and income inequality for years to come.

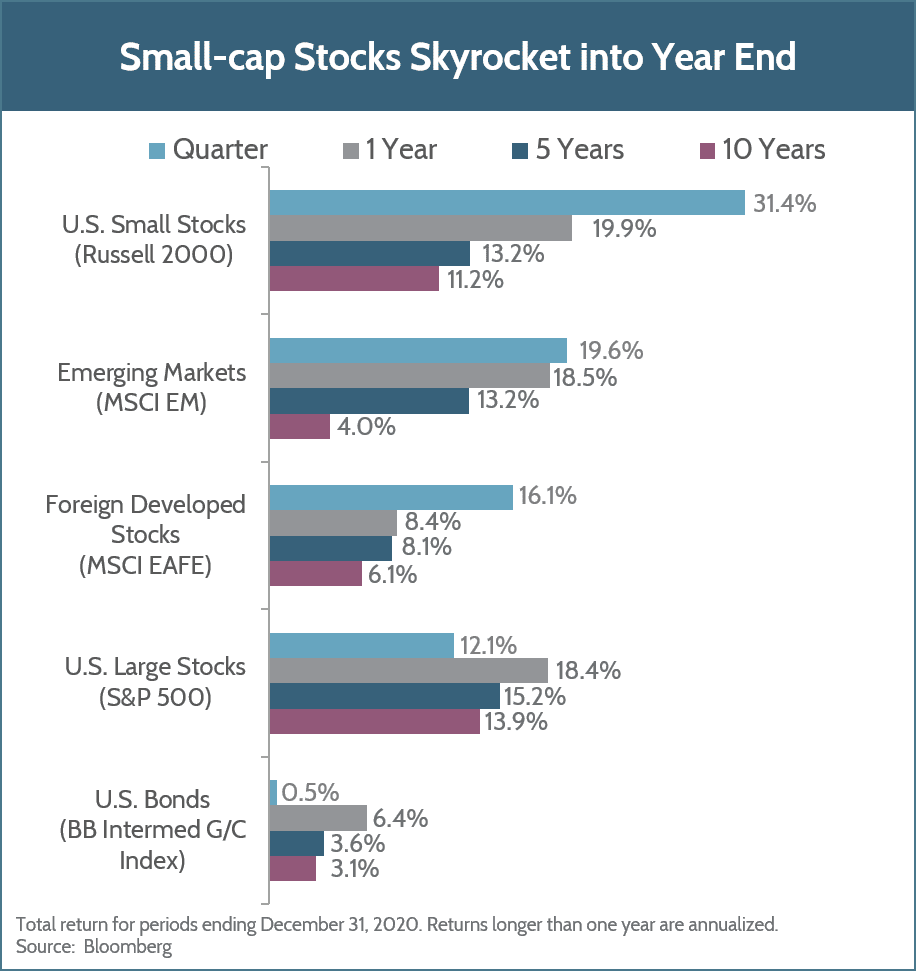

Global stocks had an incredible fourth quarter as news of an effective vaccine in early November catapulted them into year-end. Small-company stocks surpassed the S&P 500 (an index of the largest U.S. companies) in mid-December to become the best-performing asset class for 2020 – up 20% for the year and 31.4% in the fourth quarter alone. The S&P 500 generated a handsome 18.5% total return for 2020 in the face of tremendous volatility, with two-thirds, or 12.1% of its return generated in the fourth quarter. Emerging markets, buoyed by China, were up 19.6% in 2020, with all of that growth coming in the fourth quarter. Foreign developed stocks had a challenging first three quarters, with strict lockdowns and Brexit uncertainty keeping many investors on the sidelines. These markets turned positive towards year-end, up 16.1% in the fourth quarter to end 2020 up 8.4% for the year. We see this region of the global market as attractive and believe it may catch up to its global counterparts in 2021. Lastly, U.S. bonds also experienced an incredible year. The asset class returned 6.4% for 2020, with most of that return occurring by mid-year. However, bonds were up only 0.5% in the fourth quarter as investors rotated out of safe-havens and into stocks.

We will be publishing our 2021 Outlook in the coming weeks, so please keep an eye out for it. As always, we are staying focused on the big picture while identifying investment opportunities and mitigating risk. Overall, we are optimistic about the markets, especially international and small-company stocks, despite some challenges we see on the horizon.

We all at Fulcrum Capital wish you and your families a healthy and prosperous 2021. We hope to see you all in person this year once our world gets back to some semblance of normal.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.