October 2, 2025

Market Review: 3Q 2025

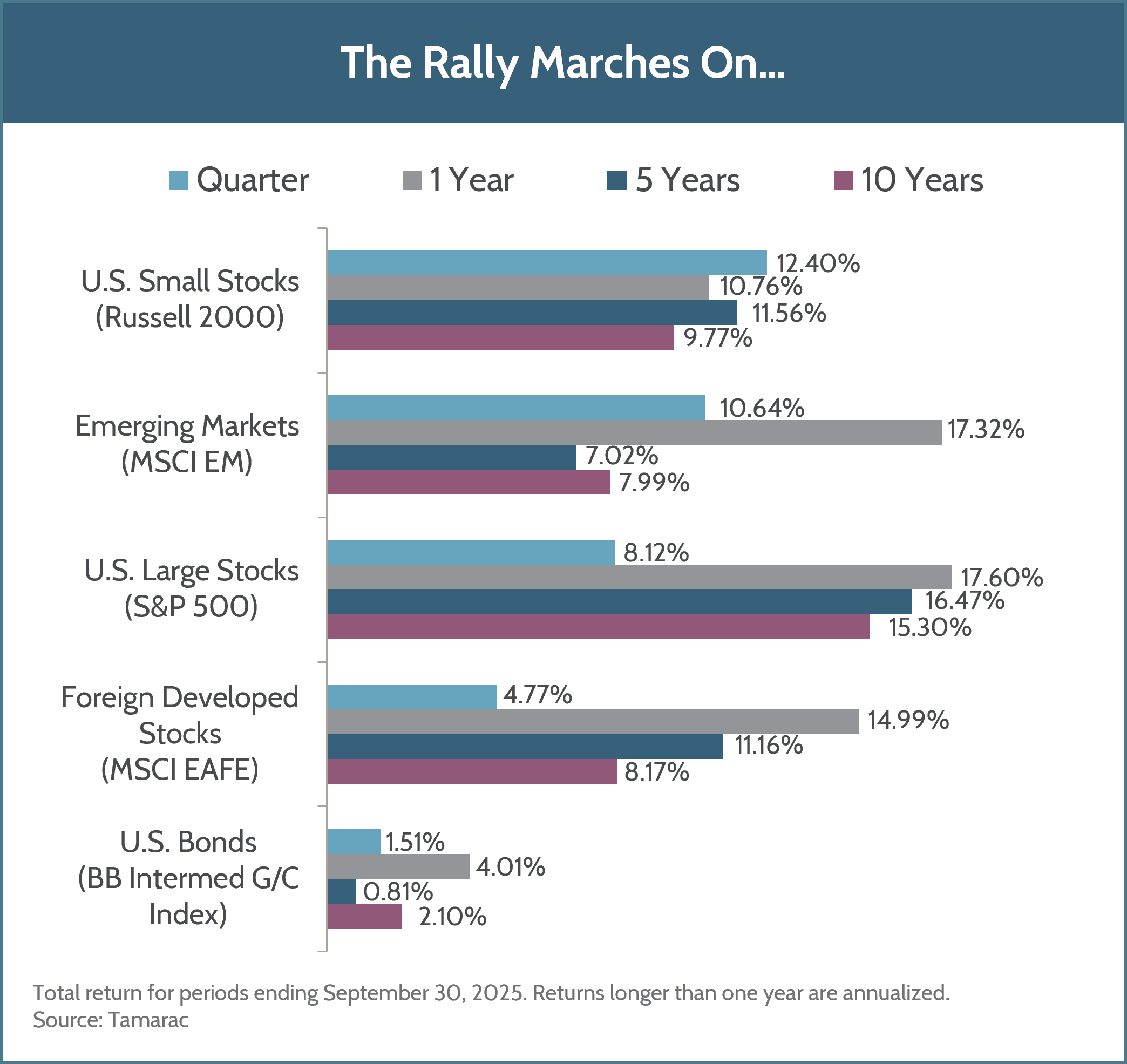

In the third quarter, financial markets built on the momentum of the post-Liberation Day recovery. The fear that gripped markets in early Q2 quickly gave way to exuberance as the rally progressed. More risky areas of global stock markets, such as small company stocks and emerging market stocks, led this rally in the third quarter, alongside other speculative stalwarts such as cryptocurrencies and unprofitable companies. In some ways, comparisons to the environment of the late 1990s feel increasingly relevant—a revolutionary technology is spurring significant investment in related infrastructure and an appetite for speculation in financial markets.

In the U.S., major macroeconomic variables such as economic growth and inflation remain muddied by policy uncertainty. Uncertainty regarding the labor market and immigration, and tariffs and inflation, have made divining where we are in the economic cycle, an already difficult task, increasingly challenging. While the picture has improved from the prior quarter, clarity around policy has been incremental. Notwithstanding the issues mentioned above, the economy continues to show resilience, buoyed by spending among high-income earners and a strong investment cycle related to artificial intelligence infrastructure.

In the face of policy uncertainty, U.S. corporations surprised analysts when they delivered second quarter earnings reports. Profit growth came in firmly above expectations and margins increased as well. Companies generally gave an upbeat message on expectations for the next quarter and, for the most part, indicated ability to manage the new tariff environment.

Looking abroad, international stocks continue to have a good year. While developed market stocks outside of the U.S. took a bit of a breather during the quarter, emerging market stocks picked up steam. Stock markets in Asia saw notable strength, with China leading the way in emerging markets and Japan leading the way in developed markets.

Bond markets also participated in the rally as expectations of the Federal Reserve lowering interest rates turned into reality. In another sign of investor appetite for risk, corporate borrowers of both high and low quality now can borrow at some of the lowest rates relative to the U.S. government in the past few decades. In fact, some corporations are borrowing at lower interest rates than the U.S. government.

As we peer into the final quarter of the year, we see a few elements to watch: the policy environment is incrementally positive, corporate earnings have momentum, and market participants seem to be in a risk-taking mood. Juxtaposed with a stock market nearing the highest valuations of the last five years, it begs the question of what happens when the heightened expectations of risk-seeking investors experience some sort of reality check. History suggests that the nascent government shutdown should have little impact on markets, but the stakes are elevated this time and that could lead to unforeseen outcomes.

Volatility may create tactical buying opportunities for investors. We remain committed to disciplined portfolio management, balancing opportunities with risks on your behalf. Please reach out to your advisor with any questions or concerns about your portfolio and the impact of market changes on your long-term plans.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce the performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.