October 4, 2021

MARKET REVIEW: 3Q 2021

by Tim Clark

The global economy slowed over the past several months as the Delta variant negatively impacted the pace of reopening. We do expect the reopening to continue, with Delta creating ongoing supply chain disruptions rather than a return to economic shutdowns in the developed world. These supply chain problems are driving up costs for companies and consumers, holding inflation high, and we believe will likely persist well into next year. Skyrocketing container freight rates are one example of the effect the pandemic is having on international commerce. Spot rates for a 40-foot container from Shanghai to Los Angeles have increased 6-fold from $2,000 to $12,000, resulting in higher costs for U.S. importers. We still believe these supply chain issues are a temporary by-product of the pandemic and expect overall inflation to settle back down to a healthy 2.0 – 2.5% trend over the next several years (For more insights on this topic, please see our article, The Tide is High.)

Negative news from China was a top market theme for the quarter and will likely drive sentiment into year-end. Energy supply shocks and monetary policy tightening have resulted in slower than expected growth into the fall. China’s restrictions on domestic technology firms and private tutoring companies in the summer fueled more questions about the central government’s long-term motives. And most recently, investors were shaken by the potential default of the largest Chinese property developer, Evergrande Group, though it appears any default will be contained, with limited spillover to the global economy. As the dust settles, we expect investor attention will return to company-specific fundamentals and earnings growth. Beijing has made a huge push to open its capital markets to international investors, and we expect this to remain a priority. Areas of the Chinese economy exposed to technological innovation and the growth of the domestic consumer continue to be well positioned. For these reasons, we believe Chinese stocks are an essential part of a globally diversified stock portfolio. That said, active investment management in this market is more important than ever and we continue to assess the situation in China and will act accordingly if the backdrop deteriorates further.

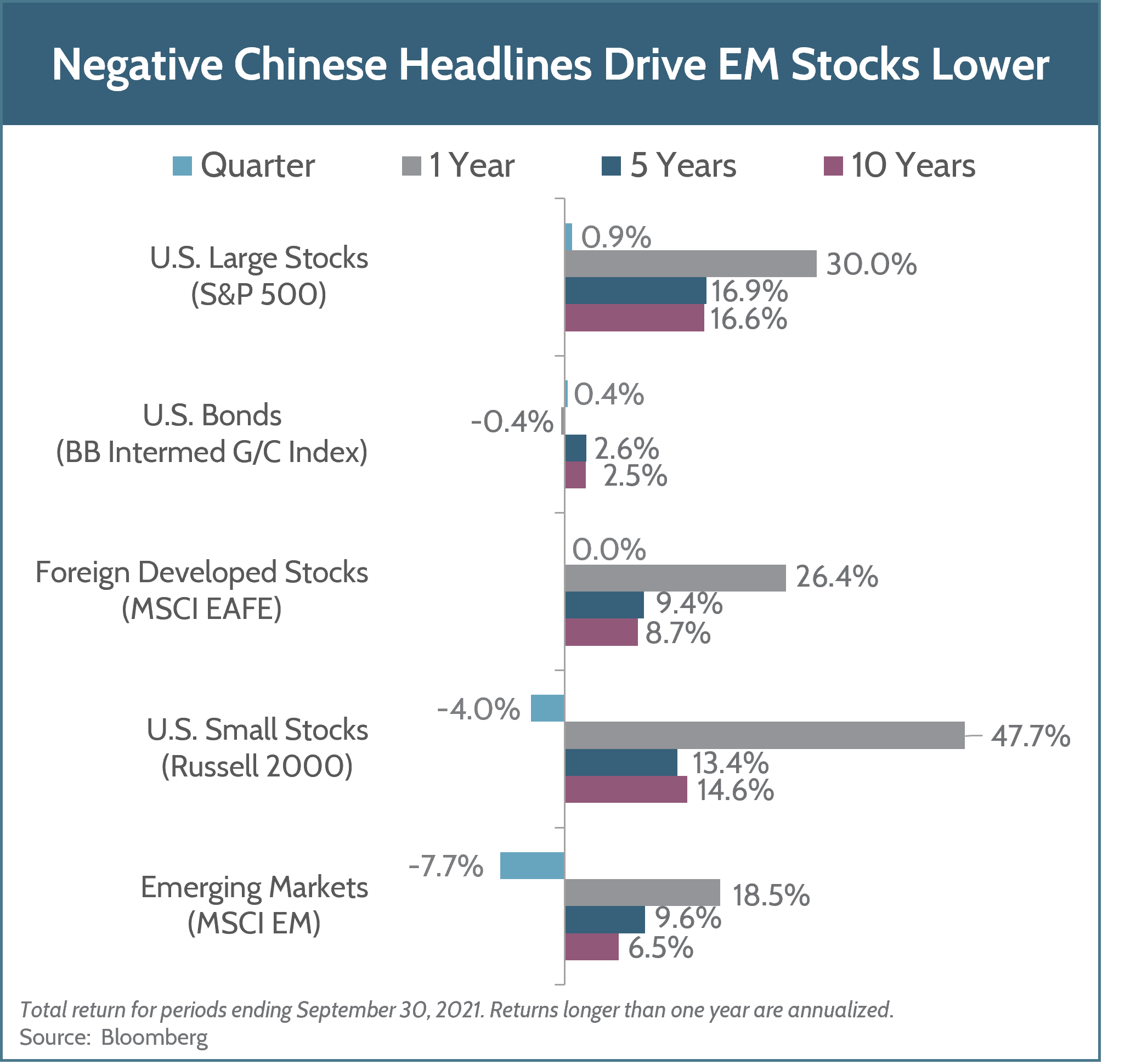

The negative news from China weighed on Emerging Market stocks, which underperformed the global developed markets for the quarter. Developed market stocks were flat over the quarter but still show robust gains for the year. The recent elections in Japan and Germany removed uncertainty and should be a tailwind for foreign developed stocks into year-end. Economic momentum has softened modestly in Europe with its growth a few months behind the U.S. and U.K. U.S. large cap stocks’ volatility increased in September due to the news from China and the Federal Reserve’s commitment to start unwinding stimulus by year-end. U.S. large cap stocks were up only 0.9% for the quarter, but reflect a healthy +15.7% return for 2021. U.S. small-cap stocks were down 4.0% for the quarter as investors sought to reduce risk. U.S. bonds generated a 0.4% return for Q3 despite interest rates moving higher at the end of September.

We are entering the final quarter of 2021 with several looming uncertainties which may cause elevated volatility. U.S. companies could be paying more corporate tax in 2022, negatively impacting future earnings and stock prices. However, the Biden Administration is having a difficult time passing its economic agenda which includes these increases. The Fed plans to unwind stimulus by the end of this year which may place pressure on stocks, especially if interest rates rise too quickly. Finally, we are watching China’s real estate market and regulation. At this point, we see China’s issues as having only modest impacts on Asia and the rest of the world. However, we stand ready to adjust portfolios as the impacts of these policies evolve in coming months.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.