October 6, 2020

MARKET REVIEW: 3Q 2020

by Tim Clark

The global economic recovery started to cool in the third quarter as fiscal stimulus lapsed and second waves of the virus hit Europe and the U.S. Much of the market recovery in the second quarter was driven by fiscal stimulus and the relaxing of lockdown measures. We dealt with the initial onslaught of the virus and resulting lockdowns; now we need to deal with the ensuing global recession. The road ahead will be challenging until we have a vaccine and clarity on future fiscal support. It is more important than ever that U.S. lawmakers agree to a second stimulus package to “avoid unnecessary hardship for households and businesses,” as Federal Reserve Chairman Jerome Powell pleaded recently. Unfortunately, pre-election politics are hampering a deal. Treasury Secretary Mnuchin and House Speaker Pelosi are making a last-ditch effort to get a second fiscal relief package passed. Talks have been in the $1.5T-$2.2T range, though doubts remain about whether a bill could pass before the November election. There is no question the quickly-approaching U.S. presidential election is poised to be one of the most contentious and consequential in recent history as the candidates’ world views and policy agendas are very different. (You can access our most recent article on the election here.)

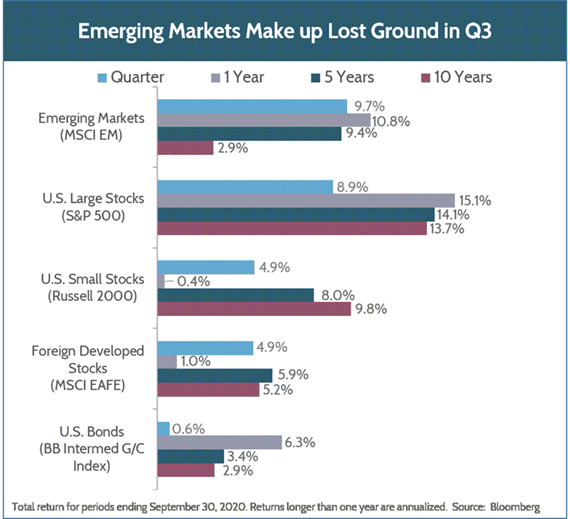

Emerging markets led global markets in the third quarter, up 9.7%, as China’s economy displayed continued resiliency following its brush with Covid-19 earlier this year. The country is well-positioned to weather the storm, and that is reflected in stock market performance – a great example of why it is important to have a globally diversified portfolio. U.S. large-capitalization stocks returned 8.9% for the quarter as the Federal Reserve clearly stated that they expect interest rates to remain at zero until at least 2025. U.S. small-capitalization stocks and foreign developed stocks also remained in the black for the quarter, with both indices gaining roughly 5%. U.S. bonds stayed flat for the period, following an impressive performance in the first half of 2020.

As we mentioned in our recently published election piece, we expect a bumpy recovery in the fall and winter months. We anticipate the upcoming U.S. election will drive volatility prior to, and likely after, the election on November 3. Moreover, a larger global Covid-19 second wave may occur as people move indoors and are forced to come in closer contact with each other. We note that the 1918 Spanish Flu’s devasting second wave, which gripped Europe and the U.S. the winter following the initial spring outbreak, was the deadliest. However, we do see a light at the end of this tunnel. Once the market digests the outcome of the U.S. election and the agenda of the victors, and we are past the tumultuous winter months, investors will turn their attention to a vaccine, which could be broadly available to the public by mid-2021.

Your Fulcrum team is here to help you navigate challenging times. We appreciate that you have entrusted us with your financial future and we work hard to ensure your peace of mind. Please don’t hesitate to contact your advisor if you have questions or concerns regarding markets, your investments, or your financial plan.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.