July 7, 2021

Market Review: 2Q 2021

by Tim Clark

The global battle against COVID-19 gained momentum in the second quarter, with vaccination efforts accelerating in nearly all developed economies. Notably, continental Europe caught up with the U.K. and the U.S. Although emerging economies continue to fall short on vaccination rates relative to developed economies, they are ramping up quickly. Governments in most developed markets have continued to ease Covid-related mobility restrictions and economic activity has improved. It is shaping up to be a typical summer in Seattle with Mariners games now at full capacity for the remainder of the season. The avid baseball fans here at Fulcrum are excited!

Year-to-date economic data has been strong, especially in the U.S., which posted 6.4% GDP (annualized) in the first quarter. We expect U.S. economic growth for Q2 to be even stronger, peaking at +9% for this cycle. All eyes will be on Europe, Japan, and emerging markets for the second half of this year as all were severely impacted in the first half by new outbreaks and vaccination delays. The Eurozone economy, for example, contracted by 0.6% in Q1. Despite this, leading economic indicators, such as the purchasing managers’ index business survey, continue to hit new multi-year highs in Europe, highlighting a robust economic backdrop for the region.

The massive global reopening has spurred inflation in some countries. The pandemic has materially impacted many global supply chains, creating undue upward pressure on prices. We believe this is a temporary by-product of the pandemic, and we expect inflation will settle back down to a healthy 2.0 – 2.5% trend over the next few years. (For more insights on this topic, please see our article, The Tide is High.)

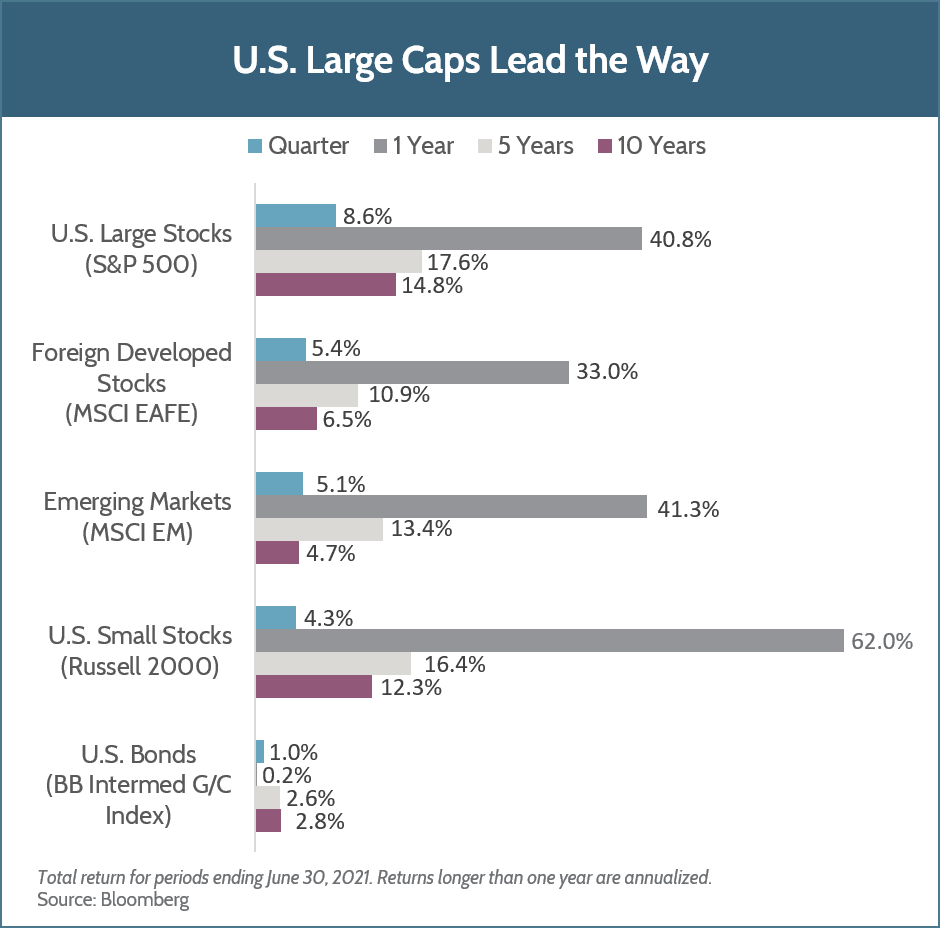

U.S. large cap stocks were the strongest of the major asset classes, up 8.6% for Q2, with the S&P 500 reaching a new all-time high in late June. Tech giants like Apple, Alphabet, and Microsoft made strong gains over the quarter. Energy, information technology, communication services and real estate were among the strongest sectors of the market, while utilities and consumer staples lagged. Foreign developed stocks increased 5.4%, buoyed by the Eurozone and U.K. markets. Japanese stocks fell behind their European counterparts in Q2, down 1.2%, as government restrictions in response to a third wave of the virus hampered Japan’s economic recovery. The Japanese government has only recently lifted the coronavirus state of emergency in most regions. Emerging market equities registered a 5.1% return over the second quarter, despite a sell-off in May as higher-than-expected U.S. inflation renewed concerns over the timing of global monetary policy tightening. Brazil was the best-performing market in the MSCI Emerging Markets index, with currency strength magnifying gains. U.S. small cap stocks took a breather in Q2, generating a 4.3% return, as investors seized profits from the unprecedented performance garnered over the previous nine-months. U.S. bonds generated a 1.0% return for Q2, albeit flat year-over-year, as interest rates paused their ascent.

We move into the second half of 2021 with an optimistic but prudent stance. We believe the U.S. market will underperform foreign developed and emerging markets over the final two quarters of 2021. Over the past several quarters, we have been positioning client portfolios to capitalize on this belief, taking profits in the U.S. market and rotating capital into foreign markets. More broadly, we expect the second half of this year will likely see a resurgence in volatility driven by historically high valuations, increased policy risk (U.S. tax increases, fiscal/monetary tapering), and the fact that we have yet to see a correction (-10%) this year which is unusual based on history.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.