July 2, 2020

Market Review: 2Q 2020

by Tim Clark

What a rollercoaster ride! Global capital markets rebounded considerably in the second quarter as global fiscal and monetary stimulus bolstered the financial system. Never in the history of capitalism has there been such a coordinated effort to stem a recessionary event. Policymakers across all major economies made unprecedented moves to navigate from the precipice of a global depression. As a result, risked assets rallied across the board, erasing much of the losses experienced in February and March.

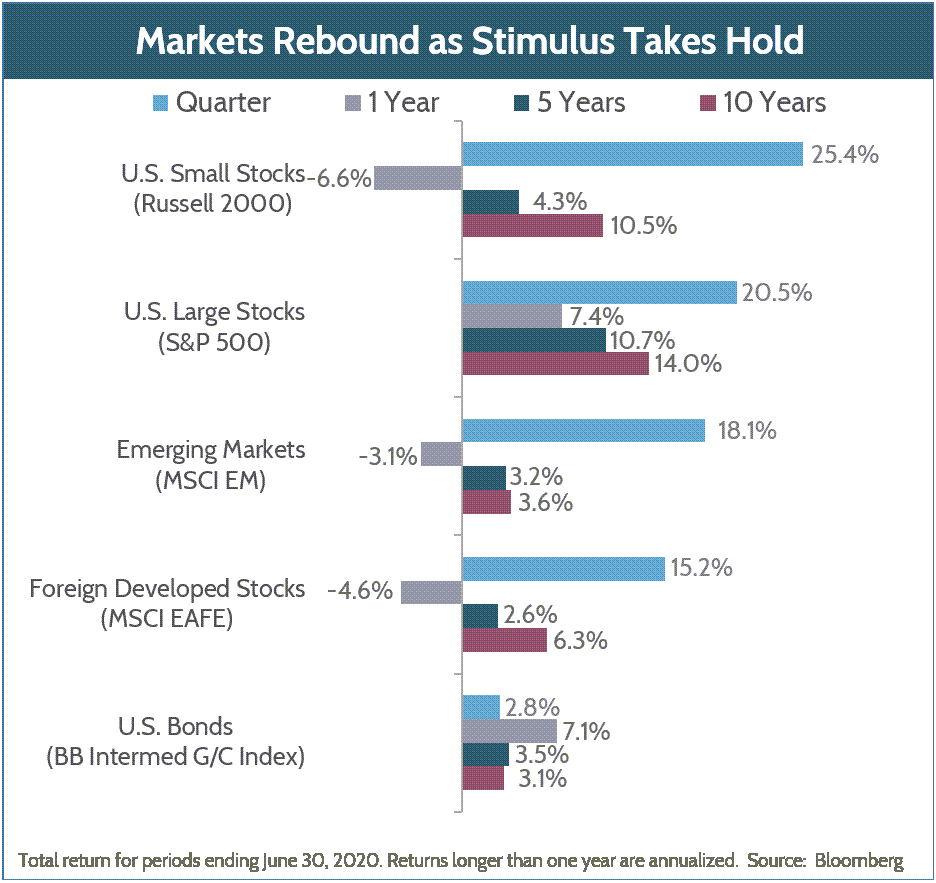

The second quarter rally was led by U.S. small-cap stocks which garnered an impressive 25% return as economic activity most likely bottomed. The S&P 500 index was not far behind, snapping its quickest bear market ever to recover over 20% in the span of just three months. The index’s performance was heavily influenced by a 28% surge in the information technology sector. Emerging markets and foreign developed stock performance, while notable, lagged U.S. stocks, earning 18.1% and 15.2%, respectively, for Q2. Bonds also had a great quarter and an even better year with the asset class up 7.1% over the past 12 months, only 0.3% behind the S&P 500! This rollercoaster drives home two key lessons for clients: 1. Diversification between stocks and bonds reduces short-term variability in portfolios, and 2. Maintain a long-term perspective; it doesn’t pay to try to time the market.

Despite the rosy performance for the second quarter, we believe we are not out of the woods yet. COVID-19 is far from being in the rearview mirror. We see evidence that a second wave is a real possibility with certain areas of the U.S., notably California, struggling to contain the virus. We believe future lockdowns in the U.S. or elsewhere will have a devasting impact to the global economic recovery, especially for industries such as retail, hospitality, and tourism. Furthermore, the fact that more than 20 million Americans remain out of work troubles us. The U.S. employment rate currently sits at over 13%, markedly higher than at the worst period of the Great Financial Crisis back in 2008/2009. Not since the Great Depression has the U.S. had such an elevated unemployment rate. Moreover, we are just starting to see the impact that ten years of cheap debt and a profound economic shock can have on highly indebted businesses. Noteworthy companies such as Hertz, Chesapeake Energy, J.C. Penny, and Cirque du Soleil sought bankruptcy protection over the past few months. We expect to see more of these high-profile announcements in the coming months and quarters. Lastly, to add to all this uncertainty, the pivotal U.S. Federal Election this fall will surely garner investors’ attention, with the potential for even greater volatility heading into November.

"Maintain a long-term perspective; it doesn’t pay to try to time the market."

We see several key themes coming out of this crisis that will drive the investment landscape for years to come. The work environment is one area where we see potential for structural changes and disruption. As a result, we believe commercial real estate and demand for office space may suffer post-COVID. We posit that global oil demand likely peaked in January of this year and will continue to be hampered by less travel, slower economic activity, and ongoing low-carbon initiatives, resulting in depressed oil prices and a beleaguered oil sector fighting to survive. We see a challenging landscape for globalization as global supply chains move home, propelling costs higher for companies and consumers. We also expect income and wealth inequality to increase, driving populist politics for years to come. And yet… this crisis will also present some notable winners. We see software, e-Commerce, health care, and ESG/Sustainability thriving post-COVID, and we are well positioned to capitalize on these trends.

Thank you for entrusting us with your financial future. Please reach out anytime if you have questions regarding your investments and financial plan. We stand ready to serve.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.