April 3, 2024

Market Review: 1Q 2024

Late 2023 optimism around an immediate Fed “pivot” was tempered in the new year as pockets of stickier inflation and a robust economy led the Federal Reserve to signal it would exercise patience in cutting rates. Despite this shift in sentiment, U.S. stocks continued the upward march that began in late 2023, posting their best first-quarter returns since 2019 with muted downside volatility.

A strong labor market and steady consumer spending supported the U.S. economy, and positive revisions were made to both 4th Quarter 2023 and estimates of 1st Quarter 2024 GDP. The economic strength also supported corporate profit growth, with many companies beating analyst expectations in recent quarterly reports. Outside of the U.S., Europe and the UK are showing signs of improvement in both their inflationary and economic outlook as services and manufacturing sectors are slowly recovering. Signs of broadening economic growth abroad and less restrictive central bank policies bode well for the global economic picture.

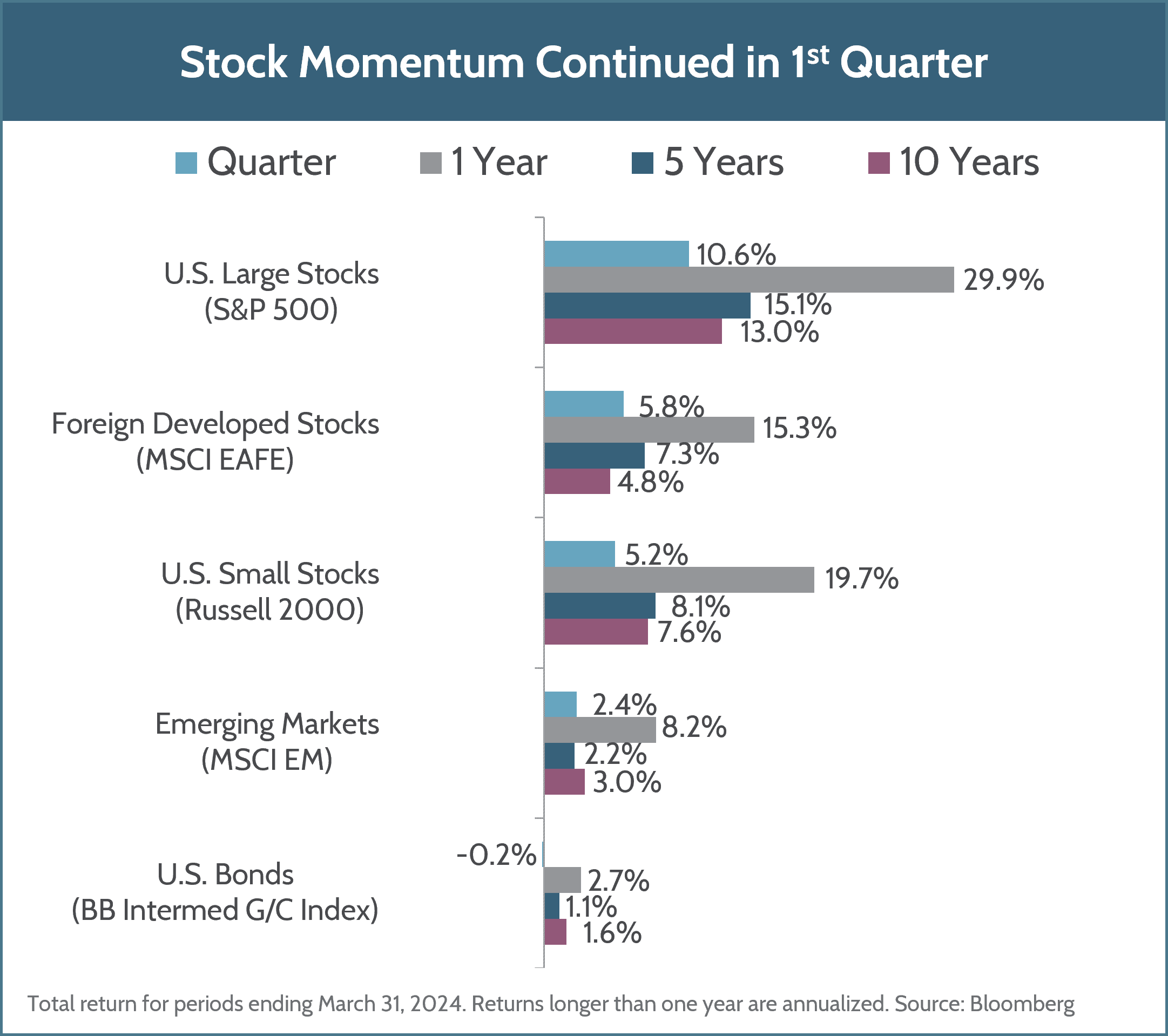

Interest rates ground higher over the quarter, causing bonds to deliver slightly negative returns (down 0.15%). This was primarily driven by investors’ acknowledgment that the Fed and other central banks would be more patient in cutting rates than initially hoped. The year began with expectations of a rate cut in the U.S. as early as March, while over the quarter, the timeframe was pushed out later into 2024. But even with shifting expectations around the timing of central bank cuts, overall volatility in fixed income markets dissipated as the general direction of policy stabilized.

For stock markets, the rise in rates didn’t impede advances in valuations, which pushed returns higher over the quarter. U.S. large-cap stocks led the way, up 10.6% for the quarter, while foreign developed stocks grew 5.7% and emerging market stocks rose 2.1%. In the U.S., rotations into cyclical sectors such as industrials, materials, and energy stocks indicated a potential rebound in manufacturing activity.

There are some signs that the last mile of inflationary relief may be the hardest, with wage gains and shelter costs remaining sticky and energy costs starting to pick up again. Lingering inflation coupled with a healthy economy may limit what the Fed can do in 2024. A pronounced return of inflation would challenge the ability of central banks to deliver at all on expectations of rate cuts, presenting a more significant risk to the broad economic landscape. At Fulcrum, we continue to focus on building portfolios that can navigate a wide range of environments while keeping your long-term planning goals in mind. Please reach out to your advisor if you have questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators for a particular investment area, such as the S&P 500® Index serving as a way to gauge the performance of U.S. Large Stocks generally. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.