April 5, 2021

MARKET REVIEW: 1Q 2021

by Tim Clark

We have seen notable progress in the global battle against COVID-19. Vaccinations are ramping up worldwide and some regions have begun rolling back social distancing restrictions. It appears that we may have turned the corner and that the worst is behind us. Global economic activity is picking up although improvement is not consistent across the world. Certain countries and regions, such as the U.S., China, and the U.K, are leading the way out of the depths of the crisis while others, such as the Eurozone and Canada, are battling new waves of infections and logistical and supply challenges.

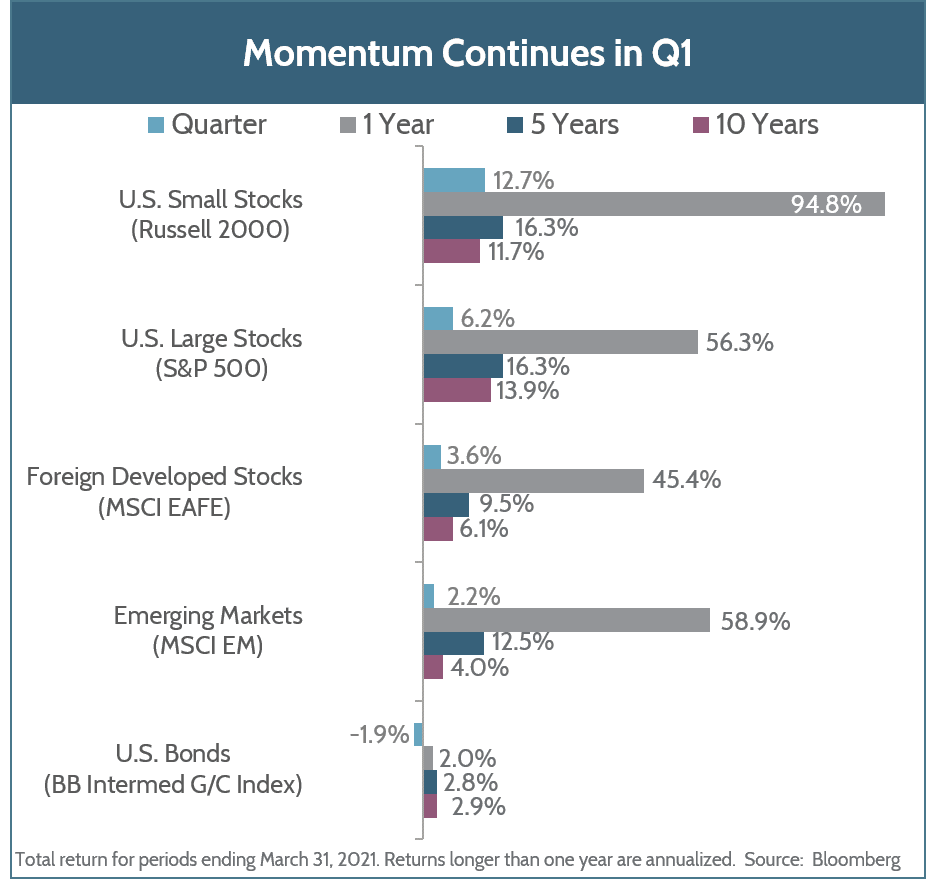

Here in the U.S., the latest $1.9 trillion stimulus package, future stimulus plans, global supply chain price increases, and skyrocketing oil prices are stoking inflation concerns. Oil prices are up +65% since the first COVID vaccine was approved in early November. The Organization of Petroleum Exporting Countries (OPEC) contributed to this rally by deciding to hold back supply to support global prices. However, the rally in oil has also been driven by the projected rebound in demand. Oil prices are typically the harbinger of economic growth. The expectation is that, as economies reopen, oil demand will recover. These inflation fears are creating considerable turmoil in the bond market and driving a wholesale sell-off of long-term bonds. The widely followed U.S. 10-year Treasury Bond yield has skyrocketed from 0.91% at the end of 2020 to 1.67% at the time of this writing. U.S. bonds were negatively impacted during Q1, down 1.9%, as inflation expectations and interest rates moved considerably higher. We believe bonds will be under pressure over 2021 as interest rates adjust to the post-Covid world.

The equity market has not been immune to these events, either. We have witnessed a meaningful rotation away from secular growth and quality areas of the market such as health care and tech, and into cyclical pockets. The rebound in oil prices has pushed investors back into the beleaguered energy sector and higher long-term interest rates have improved financial sector profitability. In a profound reversal from their precipitous drop in 2020, these two areas of the U.S. stock market (S&P 500) have been the best performers year-to-date, up 17.3% and 34.3%, respectively. This cyclical rotation may continue for another quarter or two, but we believe growth and quality will outperform in the long term.

Global stocks started 2021 strong, extending their fourth quarter rally. Small-company stocks garnered the top spot once again, generating a total return of 12.7% for the first quarter. By contrast, the S&P 500, a proxy for large-cap stocks, was up only 6.2% in Q1. Foreign developed stocks underperformed their U.S. counterparts, up only 3.6%, as pandemic challenges stifled economic activity in Europe for the quarter. We continue to expect foreign stocks’ performance will catch up as 2021 progresses. Emerging markets, led by China, also saw slower growth relative to the U.S., up only 2.2%, as inflation expectations and an improving U.S. dollar tempered investor expectations.

While the worst challenges of 2020 may be behind us, we have new tests ahead. As the global economy reopens, the challenges of inflation, debt-fueled deficits, tax increases, political and social divisiveness, and climate risk are having an impact on market expectations. We also see much to be grateful for in the spring and summer of 2021 in terms of our ability to see friends and family, travel, and get back to our favorite summer activities. We hope to begin seeing you all in person before too long.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.