April 3, 2020

MARKET REVIEW: 1Q 2020

by Michelle Mathieu

Worst! First! Fastest! Deepest! There is no shortage of superlatives to describe the public health tragedy and the devastation in the capital markets in the first quarter of 2020. On the bright side, we headed into the crisis from a position of financial strength: The global economy was on a solid growth trajectory, employment and confidence were strong, interest rates were stable, trade wars had settled down, and most asset prices were at or near record highs. Then, a microscopic bug took our entire planet hostage. By the end of February, as the gravity of the situation finally sank in, asset prices came crashing down. The imperatives are universal: First, safeguard our lives; second, safeguard our livelihoods; and third, safeguard the capital markets.

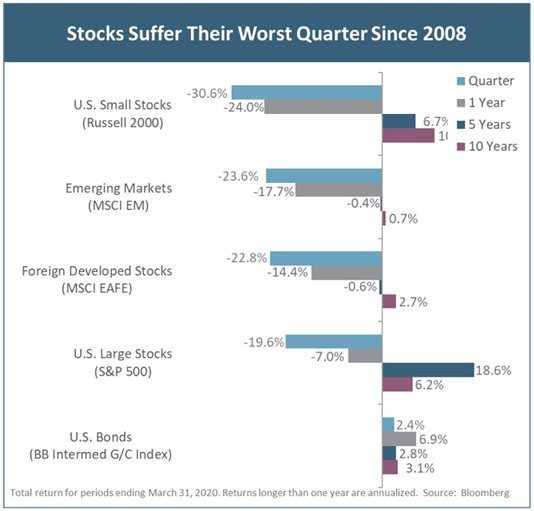

The pain was broad-based. The S&P 500 Index had the quickest bear market ever, plunging 33% in just five weeks, followed by a 21% rally over three days, the fastest since 1931. The index of large stocks ended the quarter down 20%, its worst quarter since 2008. Volatility was relentless: The S&P 500 moved up or down an average of 5% each day in March, surpassing a previous all-time high set during the Great Depression. Small stocks tracked by the Russell 2000 index suffered their worst quarter ever, down 30.6%.

Oil prices suffered their worst losses ever, with Brent Crude down more than 60% in the quarter to close at $26.35. The yield on the benchmark 10-year Treasury note hit record lows, down 1.22 percentage points to 0.69% over the course of the quarter. 30-year mortgage rates hit a record low 3.29% during the quarter. Corporate bonds were having their best start to the year ever, then pivoted into their sharpest price decline on record before massive government stimulus at the end of the quarter relieved concerns of bankruptcies and defaults.

Never before have governments shut down a large portion of the world’s production in response to a health crisis. To make matters worse, Russia and Saudi Arabia tangled in an oil price war, with excess supply and plunging demand sending the commodity into a tailspin. In the U.S., the question is not whether we will get a recession this year; the question is how severe it will be. Unemployment will likely surpass the 10.8% level last seen in 1982. The $2.1 trillion stimulus package passed by the Administration and Congress totals roughly 10% of GDP, and that will almost certainly not be enough. Drawing from the arsenal used to combat the Great Financial Crisis, the government is supporting asset prices and stabilizing capital markets with an alphabet soup of programs. Some experts estimate the budget deficit will explode to more than $10 trillion – more than half of annual GDP – from an already-ridiculous $1 trillion before the crisis. We have no doubt the economic impact will be felt for years.

We took several steps throughout the quarter to reduce risk, raise cash, and improve liquidity in our client portfolios. Unfortunately, we expect more bad news about the virus and the global economy ahead, and with that, more interim downside and volatility for both stocks and bonds. However, we do not underestimate the positive impact of unprecedented fiscal and monetary policy combined with businesses’ commitment to take care of their workers. Though the downturn will be more severe than any in our lifetime, we believe the recovery in global consumer confidence, demand and spending will be quicker than the recoveries in 2000 and 2008, where it took many years to eradicate fundamental imbalances in the economy.

Here at Fulcrum, we are thriving in our remote working environment while we safeguard the health of our employees and our community. We have our full collection of tools and systems at our fingertips without any interruption or degradation of service quality. Our financial strength allows us to continue to invest in our systems and in our people. We are taking every action to continue to provide you with the service, communication, and resources you need at this critical time. We value our partnership and the trust you have placed in us, and we remain committed to preserving and protecting your financial wellness.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.