March 27, 2020

MARCH MADNESS

by Michelle Mathieu

This market keeps dishing up surprises! Stocks just posted the best 3-day gain since 1931. The 20%-plus gain in the S&P 500 Index between Tuesday and Thursday officially counts as a bull market and marks Monday as the end of the shortest bear market in history – a drop of 35% in about four weeks. These day-to-day ups and downs are as exciting as watching an orange ball bounce back and forth across a 94-foot-long court. And, as in the foregone Sweet 16 tournament, you never know which underdog may surprise you.

Take Boeing stock, for instance. After losing more than 70% of its value in the six weeks ending March 23, it nearly doubled in price over three days to close above $180 per share yesterday. But don’t let the math fool you: Boeing is still down almost 50% over that stretch!

This is a classic example of the short-sightedness that accompanies crises. It’s human nature: we focus on the bright and shiny information right in front of us, rather than more important information that is further out.

In my training as a paragliding pilot in 2008, one of the first things I learned was how to recognize and counteract the tunnel vision that happens when you’re coming in for the landing and the only thing you can focus on is the ground rapidly accelerating toward you. Avoiding this “looming effect” of tunnel vision is crucial to survival. Because what you focus on is where you go.

Michelle Mathieu flying and landing a paraglider on September 24, 2008 at Tiger Mountain.

Photo credit: Nancy Rubesch

As professional pilots for your financial plan, we have built-in circuit breakers that help us avoid the lure of the short-term—whether it’s the siren song of cheap bargains that often turn out to be traps, or the panic and fear of the rocky ground rushing toward us.

So, our job as pilots is to keep our eyes high and focused on the landing zone, not what’s going on in between. Our training focuses on these areas: We evaluate decisions unemotionally. We eliminate distractions and manage our workload so we can think clearly. We use checklists. We follow our policies and procedures. We have pre-identified the conditions that will warrant a change in plans, and we always pre-plan alternative routes in case those conditions come into play. Our Crisis Playbook is a great example of this, along with our running checklists: “What Really Matters,” What Could Go Right,” What Could Go Wrong,” and “Four Investment Pillars.” All this training and discipline helps us be proactive, not reactive.

The rally in the stock market and the massive policy response to the virus are both reassuring and hopeful. That said, we do expect this optimism to fade over the next couple of months. For example, most respondents to this week’s University of Michigan consumer sentiment survey said they expect the U.S. will avoid a recession, and most expect their income will rise a year from now. Neither of these is likely.

Typically, the Bottom (with a capital-B) is reached only when optimism is nowhere to be found. Clearly, optimism still hasn’t been entirely eradicated and replaced by capitulation and exhaustion. Unfortunately, we do expect more bad news about the global economy ahead, and with that, more downside to both stocks and bonds in the interim. We have no idea how long it will take, how much worse it will get, or when and where the next surprise geyser, like the one we saw this week, will erupt.

Regardless of where the only-visible-in-hindsight Bottom lies, the conditions that make bargains available certainly are materializing here. The fact that we’re not necessarily at the trough yet, and the fact that stock indexes are up more than 20% in three days, are not arguments against being fully invested.

Banks and other businesses entered this crisis in the best shape in decades, and they are committed to taking care of their workers. Additionally, trillions of dollars of federal spending is on the way to backstop these businesses and support individuals. In every one of the last four economic crises, the positive impact of policy response was consistently underestimated. We believe the recovery in global consumer confidence, demand and spending will be quicker than the recoveries in 2000 and 2008, where it took many years to eradicate fundamental imbalances in the economy.

When the market can move up or down 20% in a matter of days, you can get your head handed to you if you react to either panic or greed. The speed of the fall and the speed of the recovery are due in large part to the widespread growth of passive indexing, algorithmic or program trading, short-selling, short-covering, and other speculative activities. This is precisely the time for us to bring all our training and experience to bear, to stick to our discipline, and to follow the Playbook. We may miss out on some short-term opportunities, but our eye is on the end game.

Thank you for trusting us for your safe landing. And, keep your eyes high. You might catch some amazing views along the way.

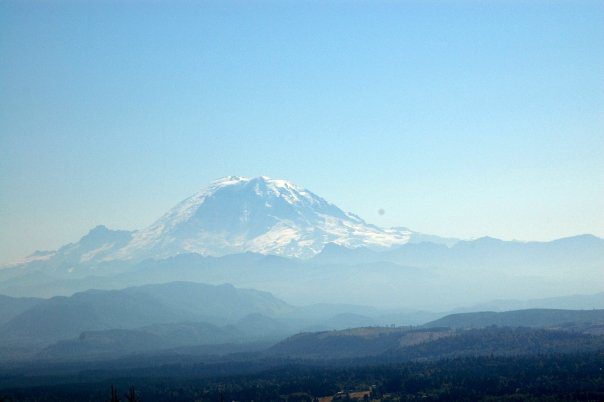

View from Tiger Mountain on September 24, 2008.

Photo credit: Michelle Mathieu

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.