September 25, 2020

DECISION 2020: POTENTIAL OUTCOMES

We’ve had a wild ride in the markets this year. In our view, the most recent market volatility has been driven by several factors, including a lack of clarity about future fiscal stimulus from Washington (i.e. CARES 2.0), a global second wave of Covid-19, and the upcoming U.S. federal election. We expect this volatility will likely continue at least until the election. But what is likely to happen after November?

We see three likely scenarios coming out of the U.S. elections this fall: business as usual, a Democratic sweep, and rival parties in control of the Senate and White House. All three scenarios will result in different outcomes for Americans and differing impacts on the markets and your investments.

Prediction Markets

In the weeks following the party conventions, polls continue to show Biden favored to win the presidential election and the Democrats slightly favored to take back the Senate. Prediction markets like Predictit.org also show Biden favored over Trump, while the prediction odds of a full Democratic sweep are only about 50% as of this writing. Perhaps the most reliable indicator, for better or worse, is the stock market. The performance of the S&P 500 Index in the three months before the election has correctly “predicted” every election since 1984 and 86% of the elections since 1936. The factors that make voters dissatisfied (incumbent party loses) are generally the same factors that make investors dissatisfied (stocks go down). We are currently at the halfway mark and the market is flat; this indicator is dead even.

Between the polls, prediction markets, and market indicators, the election outcome is no more certain today than it was six weeks or six months ago. The country is, unfortunately, hotly divided, and we should be prepared for any outcome. We expect election-induced market volatility could continue into 2021 given extreme polarization and the risk of vote recounts, contested results, Supreme Court interventions, and refusals by either candidate to concede.

Regardless of who wins, we expect low interest rates, deficit-financed stimulus, geopolitical tensions, and scrutiny of social media companies to continue. Under either administration, we believe the secular trends that were accelerated by COVID-19 will remain in place, including big companies becoming more dominant; globalization declining as supply chains move home; remote work and technologies reconfiguring the way people work; and peak oil demand leading to lower oil prices.

The Status Quo

President Trump’s plan is to reduce taxes further, continue deregulation, increase scrutiny on healthcare and social media companies, and pressure the Federal Reserve to keep interest rates low (maybe even negative) to assist the U.S. economic recovery. If he is re-elected and the Republicans maintain their Senate majority, these will likely come to pass. The President will continue his efforts to decouple the U.S. from China, re-shore manufacturing jobs to the U.S., and use tariffs as a threat against China as well as allies in the European Union, Canada, and Mexico. Although President Trump has not explicitly opposed minimum wage increases, his policies are generally favorable to employers and unfavorable to labor unions. His proposed corporate tax cuts total $329 billion over ten years, and the markets will respond well to that prospect. However, according to the Congressional Budget Office, these types of cuts have a much lower growth multiplier than actions such as increasing infrastructure spending: 0.5x vs. 2.5x, respectively, so long-term growth may suffer.

Democratic Sweep

It’s probable that the Democrats will maintain control of the House of Representatives. All 435 House seats are up for election with Democrats holding 232, Republicans holding 198, and a lone Libertarian holding one seat. The four vacant seats were held by three Republicans and one Democrat. If Republicans hold those three and all of their current seats, they would still need to gain 17 seats to regain control, and that does not seem likely.

The resiliency in stocks as the odds of a Democratic sweep rose this summer was, at first glance, perplexing. Biden’s platform has a partial unwind of the 2017 tax cuts President Trump implemented, which would be moderately bad for stocks. However, we believe U.S. companies that generate revenue from China and Europe could benefit from a less confrontational administration. Higher regulation and taxes would raise costs for U.S. drug manufacturers and energy companies, leveling the global playing field since foreign energy companies already face these costs in their home countries. A Democratic sweep will likely mean higher aid to state and local governments, increased infrastructure spending, and immigration reform. In particular, infrastructure spending has a high growth multiplier and could be a long-term positive for the U.S. economy. Biden has stated that much of his proposed $7 trillion increase in government spending over the next decade will seek to address racial inequality, including $100 billion to build new affordable housing units.

Increased spending brings increased deficits. As mentioned, there will, in all probability, be higher taxes, as well. The Tax Cuts and Jobs Act of 2017 cut the corporate tax rate from 35% to 21%, and Biden’s proposal would raise it to 28%, bringing U.S. corporate taxes in line with the OECD average of 27%. If enacted, the Biden tax hike is estimated to reduce S&P corporate profits by more than 10% in 2021. For individuals earning over $1 million, capital gains would be taxed as income, and combined taxes on small businesses would rise. While some believe that a Biden administration would hold off increasing taxes until the economy is on more solid footing, it’s also possible that, in a Democratic sweep scenario, Biden (who, at age 77, is likely a one-term president) will not wait for the economy to recover fully before raising taxes and increasing regulation.

Divided Power

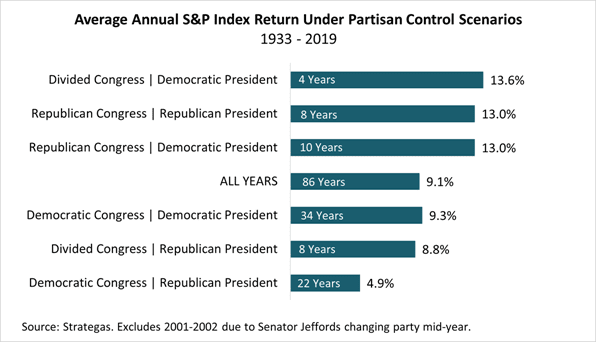

The Democrats need a net gain of three seats to take control of the Senate if Biden wins, and four if Trump remains in power. If the election ends with a Democrat in the White House and a divided Congress, or if Trump remains in the White House but the Senate flips, we’d expect to see gridlock in terms of tax rates and spending. Of the various scenarios, a Democratic administration with a Republican-controlled Senate will have the greatest fiscal restraint. Additionally, the stock market has performed best under a Democratic president and split Congress. However, it is worth noting this partisan control scenario has only happened once since 1933 – for four years in the middle of the Obama administration. The market’s worst performance has historically occurred under a Republican president with either a divided Congress (8.8%, 8 years) or a unified Democratic Congress (4.9%, 22 years).

Debt and Deficits

Regardless of which scenario plays out, the U.S. may well exceed the World War II deficit peak for decades to come. In the late 1940s, the national debt was over 100% of GDP. The Congressional Budget Office predicts that we will breach that level in 2021. Large tax increases and spending cuts, rapid GDP growth, and higher inflation are all potential options for reducing the debt. However, the first is not politically feasible, particularly with a divided government, and the second and third are not economically likely. The Republicans historically were the party that sought fiscal restraint, and that no longer seems to be the case. High levels of national debt may be the norm for the U.S. going forward, and this will likely keep a lid on economic growth, interest rates, and long-term asset prices.

Regardless of the outcome of the November elections and any resulting volatility, it is important to remain focused on the long term with regard to your investments and financial plan. The economy and markets have always followed cycles; your Fulcrum Team is here to help guide you through the turbulence.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.