July 2, 2025

Market Review: 2Q 2025

The Trump administration’s tariff plans escalated early in the second quarter, and global stock markets deteriorated rapidly as investors attempted to predict the growth and inflationary impacts of significantly higher tariffs on US imports and the potential for a larger trade war. Consumer and small business confidence fell while inflation expectations and policy uncertainty pushed higher. Equity volatility hit levels that investors hadn’t experienced since the early days of the pandemic back in March of 2020. Meanwhile, outside a precipitous drop in sentiment across consumers and investors, “hard data” such as the unemployment rate, inflation prints, job and wage growth, as well as consumer spending held up relatively well.

The labor market continued to grow, albeit at a slower pace, with unemployment maintaining stability at 4.2% and wage growth up 3.9%. Headline inflation rose 2.4%. Also, after the initial Liberation Day tariffs were announced in early April, many tariff pauses were subsequently publicized, and selective trade deals were reached later in the quarter.

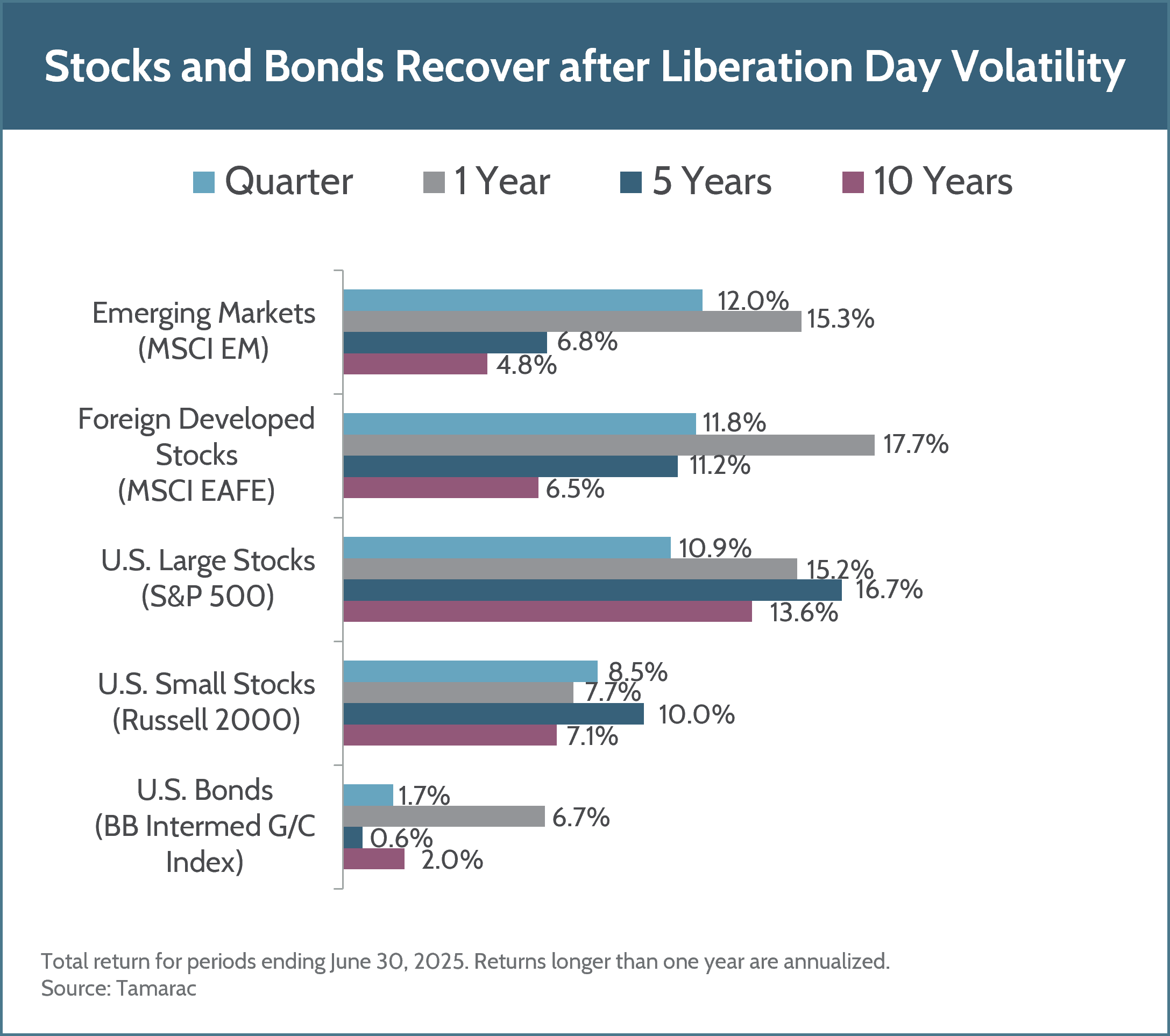

Although the S&P 500 nearly entered “bear market” territory early in the second quarter, drawing down nearly 19% through April 8th from the highs of February, the return for the full second quarter saw a dramatic recovery with large-cap stocks up 10.9%. Small-cap stocks also recovered from the April drawdown period, but lagged larger-cap stocks, rising 8.5% over the quarter.

On the back of a falling US dollar, international developed and emerging markets led global stocks higher over the quarter, with emerging markets stocks rising 12% while developed stocks rose 11.8%, both outperforming US markets. With positive momentum for foreign markets in both economic fundamentals and earnings growth, international stocks pushed higher.

U.S. intermediate bonds delivered positive returns of 1.7% while the Fed continues to signal a wait-and-see approach to rate changes. As long as the labor market maintains a healthy status and inflation hasn’t made enough downward progress towards their intended target, they have the ability to take their time. Also, the potential passing of a large fiscal bill that adds to deficits was not meaningfully pressuring rates in the first half of the year.

Although markets have dramatically recovered over the quarter, the full impacts of potential policy changes have not been fully felt across the globe. We continue to closely monitor economic and business fundamentals as well as the impact of fiscal, monetary, and trade policies on those fundamentals once they are finalized and implemented. Please don’t hesitate to reach out to your advisor if you have any questions or concerns.

Unless otherwise noted, data presented in this report is from recognized financial and statistical reporting services or similar sources including but not limited to Reuters, Bloomberg, the Bureau of Labor Statistics, or the Federal Reserve. While the information above is obtained from reliable sources, we do not guarantee its accuracy. This report is limited to the dissemination of general information pertaining to Fulcrum Capital, LLC, including information about our advisory services, investment philosophy, and general economic and market conditions. This communication contains information that is not suitable for everyone and should not be construed as personalized investment advice. Past results are not an indication of future performance. This report is not intended to be either an expressed or implied guarantee of actual performance, and there is no guarantee that the views and opinions expressed above will come to pass. It is not intended to supply tax or legal advice, and there is no solicitation to buy or sell securities or engage in a particular investment strategy. Individual client needs, allocations, and investment strategies differ based on a variety of factors. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators. Index performance does not include the deduction of fees or transaction costs which otherwise reduce the performance of an actual portfolio. This information is subject to change without notice. Fulcrum Capital, LLC is an SEC registered investment adviser with its principal place of business in the state of Washington. For additional information about Fulcrum Capital please request our disclosure brochure using the contact information below.